Publications » Brochures, booklets or fact-sheets » Quality Tracking System for Steel Coils

Quality Tracking System for Steel Coils

Downloads and links

Recent updates

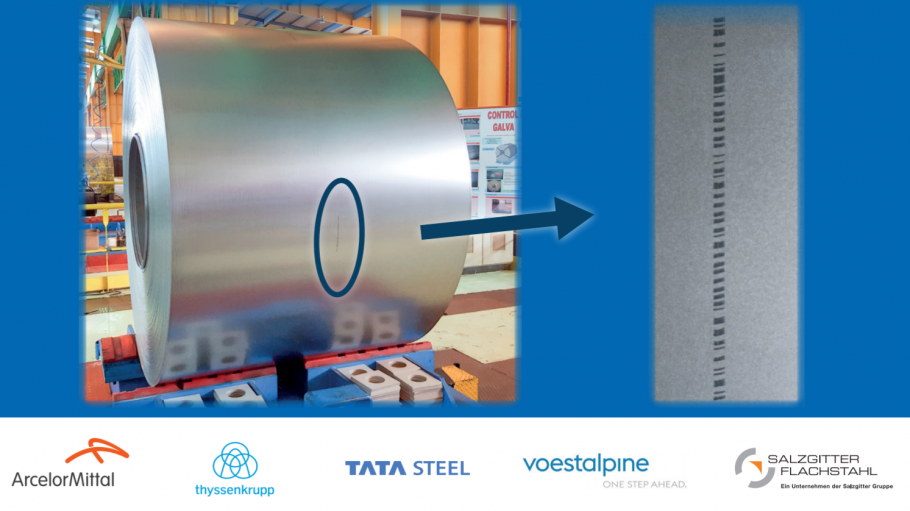

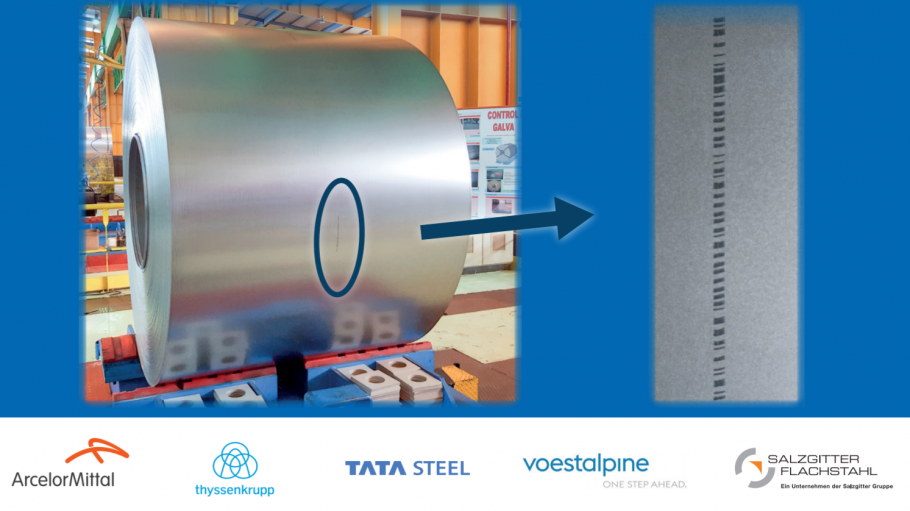

Flat steel products, such as sheets, are often delivered to customers as coils. Coils are easier to transport as several hundred metres of steel can be shipped in a relatively compact load. However, steel coils can have isolated quality issues – imperfections – at points along their length. These isolated flaws can disrupt customers’ processes as finished parts containing the imperfections may be rejected during quality control.

As early as the 1990s, steel coil users began expressing their interest in an information tracking mechanism capable of tracing these imperfections. Steel producers have worked together since then to develop a technology that can track coil information with a high degree of precision. This technology is called the Quality Tracking System. The main function of the Quality Tracking System is that it can provide additional information about the coil without requiring changes to any quality standards.

In addition, the Quality Tracking System can also be an enabler for companies that are looking to transition to Industry 4.0.

Download this publication or visit associated links

Brussels, 20 February 2026 – EU steel exports to the United States fell by 30% in the second half of 2025 compared to the same period in 2024, after the imposition of 50% tariffs according to new Eurostat data. The expansion of the U.S. tariff regime to include downstream steel-intensive products, such as machinery and equipment, is expected to amplify its impact on both EU steel producers and their customers. The European Steel Association (EUROFER) said the figures underscore the need for any EU-US trade agreement to be fair, balanced and enforceable.

Joint Industry Statement

Brussels, 11 February 2026 - The European Steel Association (EUROFER) has backed a call to action adopted by European companies and industries in Antwerp today, which includes a demand on the EU to take urgent action to bring electricity prices down as a condition for Europe’s industrial drive, competitiveness and economic resilience.